Creating jobs, reducing poverty IV: What policy approach to enable the informal sector?

Preamble

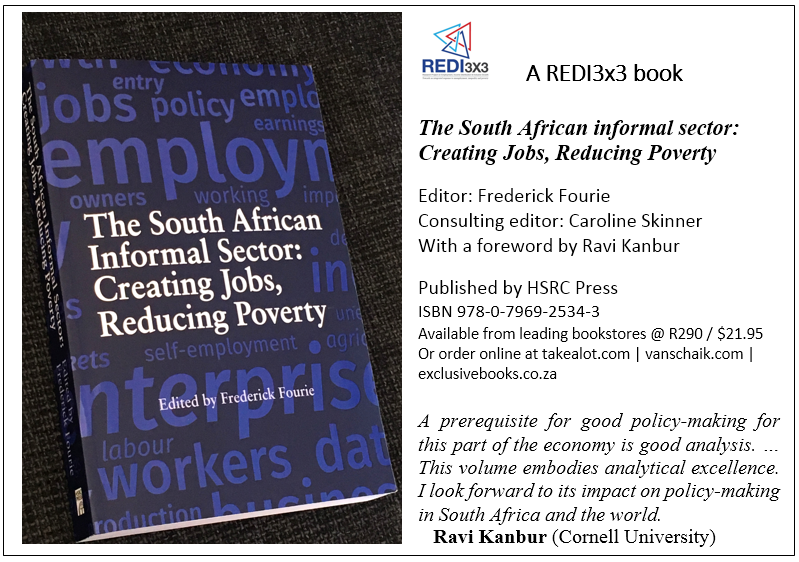

This is the fourth in a short series of edited extracts from a new REDI3x3 book: The South African Informal Sector: Creating Jobs, Reducing Poverty. The research findings reported in the book address a significant knowledge gap in economic research and policy analysis.

The book flags the importance of explicitly addressing the informal sector in policy initiatives to boost employment and inclusive growth and reduce poverty. Its last chapter – from which the extracts are drawn – generates a synthesis of key findings on the informal sector and develops the outlines of a proposed policy approach.

This extract considers what would constitute an appropriate and ‘smart’ policy approach to enabling the informal sector. Previous extracts presented a compact picture of the size and impact of the South African informal sector, analysed the employment-generating performance and potential of the sector, and discussed the barriers and constraints faced by informal enterprises and workers. Forthcoming articles will discuss a constructive way to approach the possible ‘formalisation’[1] of the informal sector.

* More information on the book is provided at the end of this article

Introduction: Enabling the forgotten sector

In conveying a compact picture of the informal sector in the first extract, I stated our considered view that the informal sector is ‘too big to fail’. This was based, first, on the substantial employment levels in the sector – about 2.3 million people in 2013, of whom almost half work in multi-person enterprises. In 2018 the total reached 2.9 million. Secondly, there is the extent of employment creation: around half a million new jobs per year from new enterprise entry as well as employment growth in existing enterprises. In addition, informal-sector employment plays a substantial role in reducing poverty levels.

The previous article described the various barriers and obstacles, including segmentation and structural constraints, faced by informal enterprises in terms of survival as well as employment growth. The presents them with a particular vulnerability and particular needs for policy support to increase their chances of being viable and self-standing. What should then be the policy approach to the informal sector?

Enablement, development and institutional differentiation

The overall policy goal must be to retain existing employment, increase the livelihoods, security and income of those already in the informal sector, and address barriers to entry and growth to create scope for newcomers and employment expansion. But how is this to be attained?

Essentially, policy must enable and support enterprises and enterprise owner-operators in the informal sector. Three perspectives on, and elements of, enablement need to be stressed:

-

Policy analysts and policy-makers who tend to focus largely on the plight of ‘own-account workers’ must realise that multi-person enterprise operators (i.e. employers) must also be supported by policy – otherwise half of the people working in the informal sector will be excluded from policy support. An enterprise-based policy framework, rather than a person-based framework, is the key to such inclusiveness. Recognising and supporting the increasing employment orientation (and extent of paid employment) in the informal sector seems to be crucial.

-

Likewise, those who want to focus largely on firms that already display entrepreneurial ambition by having employees and not being overtly ‘survivalist’ must realise that support for one-person enterprises (i.e. non-employing owner-operators) is essential, otherwise half of informal-sector workers and 80% of informal-sector enterprises will be excluded from policy support. Therefore, recognising that ‘own-account workers’ are embryonic enterprises with a substantial role in reducing poverty and creating livelihoods and employment – and, for some, potentially expanding employment – is the second key element of an inclusive informal-sector policy framework.

-

From the latter flows a third key element of enablement: to adopt a developmental approach to informal enterprise policy. This suggests, as an overarching criterion and consideration for policy, broadly seeing informal enterprises – whether one-person or multi-person – as situated on a developmental spectrum (or trajectory) from embryonic to mature states, some ‘survivalist’ and others ‘growth-oriented’, having different aspirations, entrepreneurial aptitudes, degrees of development, complexity and capacity – and different needs and challenges.[2] Enterprises across this entire spectrum will always be there, some with employment and growth aspirations, others not.

Policy measures should be designed, differentiated, targeted and fine-tuned with these three elements in mind. Certain policies will be appropriate for current multi-person firms and potential multi-person firms to enable them to grow if they have not already. Other types of policy may be valuable to, for example, one-person firms that have little growth orientation. Enterprises of all sizes need support, but the intervention should be appropriately targeted based on factors like the current stage of the enterprise and the current goals, orientation and capacity of the owner-operator. Such factors could be used in determining the eligibility of enterprises/operators for different types of policy-support measures.

As shown in the research, a central factor and, perhaps even, catalyst in this trajectory is the extent to which the informal enterprise realises elements of being an organisationally stand-alone institution. Among others, for both one-person and multi-person enterprises this involves differentiation and separation from the household, in the first instance financially (facilitated by keeping accounts for the business). Separation in terms of location and premises, where possible, is likely to complement this.

Other enterprise-based policy implications

In the sampling of policy-relevant elements from the various chapters in the book (see the previous articles in this series), several enterprise-based policy implications were extricated from the research. Many relate to the developmental state of the informal enterprise: entry and establishment, productivity and profitability, viability and sustainability, employment expansion and propensity to employ, survival and prevention of exit (including protection against severe cyclical downturns). Policies and regulations need to take these into account explicitly. They also need to be guided and differentiated by factors such as:

- reasons for operating the business and strategic vision;

- start-up resources and capacity (early vulnerability);

- growth and employment orientation;

- prior work experience of the owner;

- being a non-employer or employer (one-person or multi-person enterprise);

- gender dimension;

- industry/sector (e.g. tradeable/non-tradeable, employment intensity, possible links to the corresponding formal-sector component);

- location (urban/rural, residential/non-residential, zoning categories);

- premises (separate, suitable and secure);

- property rights and title deeds;

- access to finance and credit;

- utility services, facilities and infrastructure;

- broad training needs (keeping separate accounts, managerial and competitive awareness, accessing new markets, utilising government support programmes);

- structural barriers to accessing informal or formal (higher-value) markets.

This list points to a stimulating agenda for further research on informal-sector evidence and policy.

These aspects bring to mind the list of intervention areas that is typically found in informal-sector surveys in the literature and South African studies[3] as well as policy documents.[4] Factors often identified by respondents are:

- access to financial services and credit;

- skills training;

- business premises and facilities (business infrastructure);

- basic utility services (water, electricity, internet);

- crime and security;

- access to markets and procurement;

- access to government support services; and

- permit and licensing requirements, harassment by police or local authorities.

What our research findings serve to do, is to objectively confirm, in the data, the impact and relevance of these (and other) factors. Furthermore, the nuanced policy-relevant findings and insights distilled from our research are directly relevant in a consideration of the goals, focal points, design and implementation of policy frameworks and support measures. (This applies to both comprehensive national policies and, for example, area-specific or industry-specific initiatives.)

More specifically, whilst key areas of intervention may seem more or less settled, the conceptualisation, design and implementation of support measures need to be differentiated, nuanced and ‘smart’. Accurate information from research (such as ours) is essential for designing intervention measures so that they optimally target the existential and developmental needs of the spectrum of informal enterprises.

For instance, it is one thing to say ‘training and skills development’ or ‘suitable premises’ must be provided.[5] It is another to customise training and skills development to (1) assist the owner-operator to appreciate the importance of institutional differentiation and self-reliance – separating the enterprise from the household in terms of, notably, finances as well as premises; (2) then provide appropriate training in basic bookkeeping to empower the owner to achieve financial separation (including how monetary or in-kind payments to the owner and family members are to be handled); and (3) simultaneously making properly serviced and secure business premises available and assisting the enterprise when it is ready to move there. Such training interventions could also differentiate: provide one set of skills, aimed at growth, for those with more business experience and simpler skills for basic business analysis for smaller enterprises or less experienced operators.

These elements may also interact: having accounts and an informed sense of the ‘state of the business’ may make it easier for an owner to get a business loan at a financial institution – and even more so if the business has proper premises with a fixed address. Similarly, in the negative: just providing business training without facilitating access to premises or capital (or vice versa) may not be effective at all.

Another example is to recognise the high vulnerability of start-up enterprises and provide well-designed government support measures (or non-governmental assistance) to try to reduce early failures. While such support will probably involve the above list of interventions, at issue is a specific focus and customisation to support the vulnerable entrant. This also means using insights about, for example, the relevance of owners having prior work experience (or not) to differentiate and fine-tune enterprise-support measures accordingly – whether for own-account workers or multi-person enterprises and whether these seem survivalist or growth-oriented.

If employment creation is the specific goal of a particular policy initiative, variables and conditions that are closely correlated with a higher employment propensity should feature prominently in the design of that policy.

Other policy concerns surrounding informality – and the risk of confusion

At this point one needs to recognise that there is a different layer of policy concerns regarding the informal sector. This relates to the employment conditions and lack of social protection of informal-sector workers and other informal workers. As Chen explains (Chapter 2 in the book), this issue has gained prominence as part of a wider international programme, initiated by the ILO (International Labour Organisation). Central to this programme was the introduction of a broader concept of informal employment (as distinct from informal-sector employment). It includes, in addition to workers in the informal sector, those who are ‘informally employed’ in formal-sector enterprises (as well as households). This means they do not have employment contracts and benefits such as pension or medical coverage. (For more on these concepts and their implications, see Chapter 1 in the book.)

Concern for the vulnerability of informal workers in all sectors has led to international policy initiatives to get governments to provide social protection[6] to such workers in both the formal and the informal sectors as well as households. Several developing countries have attempted this.[7] The broader concept of informal employment is applicable and useful in this context.

In South Africa, workers in informal enterprises are about three times as many as informal workers in formal enterprises (2010 ILO data). As noted in the National Development Plan (NPC 2012: 356), South Africa has a comprehensive social protection system which includes social grants, old age pensions and a set of free basic services, education and healthcare. However, in the National Development Plan chapter on social protection it notes the vulnerability of those working in the informal sector to loss of income due to injury, illness or losing a job and proposes some policy measures (NPC 2012: 373–376).

To avoid policy inconsistency and ineffectiveness, social protection measures for individuals who work in the informal sector must be analytically distinguished from support policies for informal enterprises which are aimed at strengthening their viability and employment levels (which is the focus of our book).[8] Even when such measures are eventually presented to potential beneficiaries as a policy package, they must be conceptually distinguished – and designed and targeted accordingly.

* Failure to make such a distinction can lead to muddled policy or policy paralysis. For example, this could occur if policy advocates present the options in either-or fashion, e.g. that (a) promoting viability- and employment-supporting policies for informal enterprises is in opposition to (b) promoting better employment conditions or social protection for informal workers in the formal sector and households as well as the informal sector, or vice versa. Informality occurs in different forms in different contexts, requiring differentiated analytical treatment and correspondingly differentiated policy measures, which could then be complementary.

In considering support policies for informal enterprises, one must always be aware that in the world of policy this second layer of policy concerns is part and parcel of the discussion of (and sometimes confusion about) the informal sector. One manifestation of this complexity is found in the debate on formalisation.

Next extract: What role for formalisation in enabling the informal sector?

Download from HSRC Open Access:

https://www.hsrcpress.ac.za/books/the-south-african-informal-sector-providing-jobs-reducing-poverty

References

The edited extracts are from:

Fourie FCvN (2018) Enabling the forgotten sector: Informal-sector realities, policy approaches and formalisation in South Africa. Chapter 17 in Fourie FCvN (ed) The South African Informal Sector: Creating Jobs, Reducing Poverty. HSRC Press, Cape Town.

Referenced chapters, by number:

1. Analysing the informal sector in South Africa: Knowledge and policy gaps, conceptual and data challenges – Frederick Fourie

2. The South African informal sector in international comparative perspective: Theories, data and policies – Martha Chen

3. The informal sector in sub-Saharan Africa: A comparative perspective – Katharina Grabrucker, Michael Grimm & François Roubaud

11. Prospects for stimulating township economies: A case study of enterprises in two Midrand townships – Eddie Rakabe

16. Informal-sector policy and legislation in South Africa: Repression, omission and ambiguity – Caroline Skinner

Other references:

Chandra V & Rajaratnam B (2001) Constraints to growth and employment in the informal Sector: Evidence from the 1999 Informal Survey Firm. Washington, DC: World Bank

Charman A (2017) Micro-enterprise predicament in township economic development: Evidence from Ivory Park and Tembisa. South African Journal of Economic and Management Sciences 20(1)

Cichello P, Almeleh C, Mncube L & Oosthuizen M (2011) Perceived barriers to entry into self-employment in Khayelitsha, South Africa: Crime, risk, and start-up capital. CSSR Working Paper No. 300, University of Cape Town

DTI (Department of Trade and Industry) (2014) The National Informal Business Upliftment Strategy (NIBUS). Policy memo. Pretoria: DTI

DSBD (Department of Small Business Development) & ILO (International Labour Office) (2016) Provincial and Local Level Roadmap to give effect to the National Informal Business Upliftment Strategy. Policy Memo. Pretoria: DSBD

Gauteng Government (2015) Informal Business Upliftment Strategy (NIBUS). Johannesburg: Gauteng Province Department of Economic Development

Global Entrepreneurship Monitor (2016) South Africa report 2016/2017: Can small businesses survive in South Africa? London: Global Entrepreneurship Research Association

Heintz J & Posel D (2008) Revisiting informal unemployment and segmentation in the South African labour market. South African Journal of Economics 76(1): 26–44

ILO (International Labour Organisation) (2014) Transitioning from the informal to the formal economy. Report No. V(1), International Labour Conference, 103rd session 2014. Geneva: ILO

ILO (2015) Recommendation concerning the transition from the informal to the formal economy. Recommendation 204. International Labour Conference. Geneva: ILO

Mahajan S (ed.) (2014) Economics of South African townships: Special focus on Diepsloot. World Bank Studies. Washington, DC: World Bank

NPC (National Planning Commission) (2012) National development plan. Pretoria: NPC

Skinner C (2005) Constraints to growth and employment in Durban: Evidence from the informal economy. Research report No. 65, School of Development Studies, University of KwaZulu-Natal, Durban

Stats SA (Statistics South Africa) (2014) Survey of Employers and the Self-Employed 2013. Statistical Release PO 276. Pretoria: Stats SA

[1] The idea of formalising the informal economy has received prominence due to the International Labour Organisation’s International Labour Conference 2014 and 2015 deliberations, resulting in Recommendation 204 concerning ‘the transition from the informal to the formal economy’ (ILO 2015).

[2] The NIBUS policy document as well as its Roadmap uses a similar concept of a developmental continuum for informal businesses (DTI 2014: 24; DSBD & ILO 2016: 3).

[3] See, for example, Chandra and Rajaratnam (2001); Skinner (2005); Cichello et al. (2011); ILO (2014); Mahajan (2014) (World Bank Diepsloot report); Stats SA (2014); Global Entrepreneurship Monitor (2016); Charman (2017); Rakabe (Chapter 11 in the book).

[4] See the list in the NIBUS (DTI 2014: 39–42) and the GIBUS (Gauteng Informal Business Upliftment Strategy) (Gauteng Government 2015: 4).

[5] In terms of the current supply of training, Skinner (Chapter 16 in the book) points out that the informal sector had fallen into the gap between small businesses and the unemployed, with the SETAs (Sectoral Education and Training Authorities) having little incentive or expertise to service the specific needs of the informal sector. The NIBUS is addressing this through the SEIF programme, but is still struggling to scale up their interventions.

[6] The World Bank defines social protection as typically comprising: cash transfers to those who need them, especially children; benefits and support for people of working age in case of maternity, disability, work injury or for those without jobs; and pension coverage for the elderly. See http://www.worldbank.org/en/topic/socialprotection/overview (accessed 12 November 2017).

[7] In Brazil, for example, the government passed the ‘individual micro-entrepreneurs law’ in 2008. To qualify, entrepreneurs and own-account workers have to earn below a certain amount (gross annual revenue of less than BLR60 000) and hire no more than one employee. Formalisation starts when the entrepreneur registers with the micro-business portal and national register of legal entities, making it easier for the entrepreneur to open a bank account or request a loan. The micro entrepreneur pays a fixed monthly amount. The benefits include access to a basic state pension, disability and survivor benefits, health and maternity protection as well as a family allowance in the event of imprisonment or death of the household’s breadwinner. Medical care is provided through the public system, as is the case for workers affiliated to the general regime. Micro entrepreneurs wanting to access other benefits provided under the general regime, such as old age pensions based on individual contributions, can opt to change their status, paying a 20% contribution rate and covering any other differences (ILO 2014: 8–9). For further examples, see Chen (Chapter 2, section 4) and Grabrucker et al. (Chapter 3, section 5).

[8] Grabrucker et al. (Chapter 3) note that interventions in other developing countries have failed due to a lack of proper targeting and a focus on social protection and poverty reduction rather than a focus on enterprise development. Furthermore, not all potential and actual entrepreneurs can make good use of support.

Download article

Post a commentary

This comment facility is intended for considered commentaries to stimulate substantive debate. Comments may be screened by an editor before they appear online. To comment one must be registered and logged in.

This comment facility is intended for considered commentaries to stimulate substantive debate. Comments may be screened by an editor before they appear online. Please view "Submitting a commentary" for more information.