A redistributive approach to paying for a universal pension contribution subsidy

How could a universal pension scheme be funded?

A retirement funding tax reform could contribute to offsetting the costs associated with subsidising pension fund participation by low-income contributors. It would do so by reducing the tax benefit associated with retirement fund contributions by high-income contributors, which rises disproportionately as an indirect effect of the progressivity of the personal income tax structure. We summarize this below.

This reform would improve the progressivity of the personal income structure, and would contribute, over time, to reducing inequality. To avoid disruptive effects on disposable income, its implementation could be phased in over a few years, as part of the annual adjustments to PIT rates and schedules.

This proposal takes as point of departure that an effective fiscal incentive should be maintained for contractual savings. Currently, contributions, within limits, are exempt from tax, in-fund accumulation is largely tax-free, and drawdowns after retirement are taxed. From a welfare and incomes policy perspective, it seems clear that the social benefit of fiscal support for saving and lifetime income-smoothing declines as income and wealth rise. But it is nonetheless important to recognise that the current arrangements have the effect of deferring tax: tax relief in the contribution phase is accompanied by tax in later years on drawdowns.

A significant impact of this reform will be a narrowing of the tax-induced distortion between contractual and discretionary saving by higher income taxpayers. Although care should be taken not to discourage regulated contractual saving, a narrowing of the tax wedge between different savings forms is likely to be welfare-enhancing and to contribute to financial market efficiency.

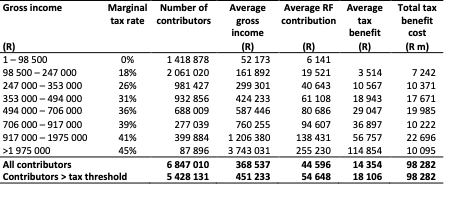

Estimates are set out in Table 1 of the 2021/22 tax benefit to retirement fund contributors, based on SARS and Treasury tax statistics for the 2017 tax year, raised to 2021 prices. The available data covers assessment of approximately 85% of revenue collected – the estimates below adjust taxpayer numbers up to align with the Treasury’s estimated total tax base and the personal income tax revenue outcome for 2016/17. These estimates include retirement fund contributors whose taxable income falls below the tax threshold.

The numbers include taxpayers employed for less than a full year. This results in somewhat higher numbers of contributors, particularly in lower contribution bands, than would be found in a survey taken at a point in time.

Retirement fund contributions are deductible up to a maximum of the lesser of R350 000 or 27.5% of remuneration or taxable income. The implied fiscal cost therefore depends on the marginal tax rate – for taxable incomes below R216 200 (or gross income including retirement funding contributions of R247 000 on average) it is 18% of the contribution; for taxable incomes above R1 656 600 (gross income of R1 975 000) it is 45%.

Table 1: Gross income, retirement fund contributions and tax benefit estimates, 2021/22

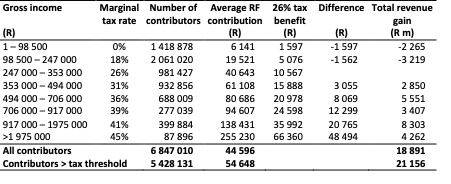

Estimates are set out in tables 2 and 3 of the implied revenue impact of two alternative tax structures.

In the first, the tax benefit is set at 26%, equal to the second marginal rate. This has the effect of raising the benefit at incomes below approximately R250 000, while reducing the tax benefit at incomes above R350 000.

This could be implemented either as a formula-based deduction or a rebate. Arithmetically, the simplest form is a rebate equal to 26% of contributions to approved funds, up to a maximum of R91 000 (equal to 26% of R350 000).

If the rebate is reimbursable, then it is in effect a subsidy to contributors below the tax threshold. In Table 2, the 26% tax benefit is shown for contributors below the tax threshold, and the total revenue gain is calculated both for a reimbursable (all contributors) and a non-reimbursable (contributors above the tax threshold only) option. In both options, there is a net gain to contributors (and loss to revenue) in the 18% tax bracket.

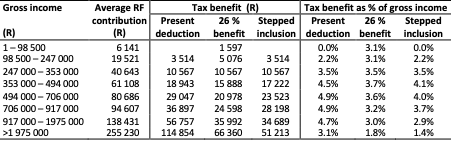

The second tax alternative, calibrated to generate about the same net revenue gain as the above, is a deduction calculated at stepped inclusion rates. The example in Table 3 has the following form:

RF contribution pa Inclusion rate Allowed deduction

< R50 000 100% Full contribution

R50 000 – R100 000 50% R50 000 + 50% of amount exceeding R50 000

> R100 000 25% R75 000 + 25% of amount exceeding R100 000

Table 2: Retirement fund contribution tax benefit set at 26 percent, 2021/22

Table 3: Stepped inclusion rate of deduction of retirement fund contributions, 2021/22

A simple comparison of the present contribution deductibility with these alternatives is set out in Table 4. Currently, the tax benefit as a percentage of gross income is highest for the R494 000 – R917 000 income groups. In the alternative tax structures, it is highest for the R353 000 – R494 000 bracket

Table 4: Comparison of RF contribution tax alternatives, 2021/22 estimates

In both these tax reform options, there is, by design, no net impact on taxpayers in the 26% bracket (gross income of around R247 000 – R353 000). In higher tax brackets, the reduced deductibility raises the tax burden progressively. At income levels above R1 million, in the absence of offsetting bracket or rate changes, tax payable increases by about 1.7% of gross income.

This analysis illustrates a possible reform of the tax treatment of retirement fund contributions that could offset the costs of subsidising universal pension coverage, while making the personal income tax somewhat more progressive.

A spreadsheet model that estimates the revenue impact of alternative parameters for the retirement contribution tax reforms discussed above is attached here.

Download article

Post a commentary

This comment facility is intended for considered commentaries to stimulate substantive debate. Comments may be screened by an editor before they appear online. To comment one must be registered and logged in.

This comment facility is intended for considered commentaries to stimulate substantive debate. Comments may be screened by an editor before they appear online. Please view "Submitting a commentary" for more information.