What is the size and distribution of the pension contribution gap?

The recently published – and subsequently withdrawn – social security green paper proposes a mandatory universal fund, with contributions at a rate of 10-12% up to an earnings level of R276 000. This would pay for a retirement pension and death and disability benefits.

If we are to assess the financial implications and impact of broadening contributory retirement fund membership, we need to know the size of the current gap in coverage. Understanding its distribution assists in thinking through options for targeting and sequencing the expansion of contributory pension funding.

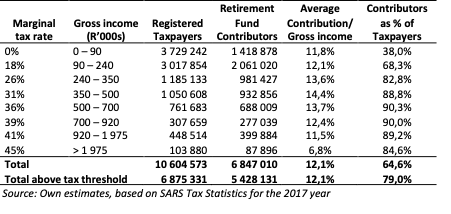

The tax statistics provide reliable indicators of coverage in the top half of the earnings distribution and can be extrapolated to provide reasonable estimates of overall coverage. IRP5 data is collected by SARS from employers for earners above R2000 a year. Taken together with returns submitted by retirement fund administrators, these provide a matched “register” of contributors and taxpayers. Although the published tax statistics cover assessed taxpayers only,[1] the Treasury’s Budget Review provides estimates of the total tax register broken down by earnings group. This allows the more detailed breakdowns of taxpayer numbers by income group in the published tax statistics to be adjusted to generate estimates of pension coverage across the full earnings distribution. In the data summarized below, adjustments have also been made to exclude those over age 65 from the taxpayer numbers.

Based on 2017 tax returns, adjusted for lags in assessment and raised to 2021 prices and the 2021/22 tax brackets, about 90% of taxpayers under the age of 65 with gross incomes above R350 000 are contributors to retirement funds, as are approximately 79% of taxpayers above the personal income tax threshold. The average contribution as a percentage of gross income is 12.1%.

This estimate of 6 847 000 pension-fund contributors should be read as a lower bound. There may be contributors who are not on the SARS register. Industry records show considerably higher numbers of clients, though these include duplicate or multiple fund involvement by some individuals.

The tax register does not provide a complete record of employment or earnings – it accounts for about two-thirds of the approximately 16 million recorded as employed in the Quarterly Labour Force Survey in 2016/17. Our estimates of the overall earnings distribution make use of QLFS earnings data for 2018 adjusted to yield aggregate earnings consistent with the national accounts. This adjusted QLFS earnings distribution generates a total number of earners above the tax threshold of just over 7 million, broadly consistent with the tax-data estimates above.

The QLFS reported 6.5 million contributors to pension or provident funds in the last quarter of 2016, out of a total of 13.6 million employees. For the first quarter of 2021, it reported 6.4 million contributors out of a total of 12.6 million employees – down from 6.6 million in the first quarter of 2020. It is notable that the decline in contributors during 2020 was just 3%, whereas employment fell by nearly 8%. The fund contribution question is not asked of employers or the self-employed, of whom about 780 000 (around 20%) earn above the tax threshold. It seems reasonable to assume that about 400 000 employers or self-employed taxpayers are retirement fund contributors. This would bring the total number of contributors before the impact of Covid-19 to about 7 million – slightly higher than the tax statistics estimate used above.

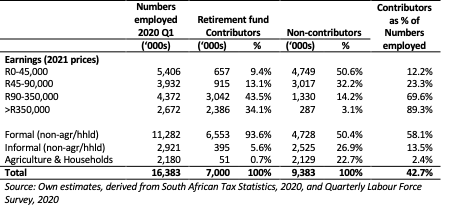

In Table 2, we blend the tax-based data reported above with QLFS employment and earnings estimates for the first quarter of 2020 (i.e before the loss of employment associated with Covid-19 and economic lockdowns). This provides estimates of the distribution of contributors and non-contributors amongst the total employed in the 15-64 age group.

Table 2: Retirement fund contributors and non-contributors by earnings group[2]

These estimates show that pension coverage is 16.8% for workers earning below the tax threshold, though nearly a quarter of workers earning between R45 000 and R90 000 a year contribute to a retirement fund.[3]Most informal sector workers and employees in agriculture and domestic (household) service are non-contributors. But there are also large numbers of workers in formal employment who do not have retirement fund membership. About 1.5 million individuals with earnings above the tax threshold are not fund contributors. The overall size of the pension coverage shortfall is 9.4 million individuals, or 57.3% of total employment (2020 Q1).

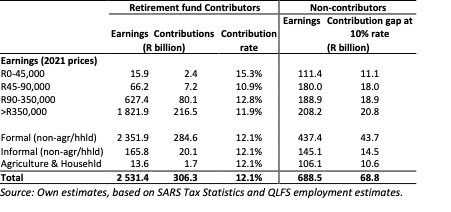

The coverage gap can also be measured as the shortfall in pension contributions by value. Estimates are provided of this in Table 3, calculated as a minimum contribution requirement of 10% of the earnings of non-contributors. The pension contribution coverage gap, measured in this way, is R69 billion, or 18.4% of the sum of current contributions and this contribution gap.

South Africa has high rates of participation of earners in the top half of the earnings distribution in occupational or voluntary retirement fund plans. This reflects the effect of tax deductibility in encouraging fund membership, and the effect of bargaining council or employer-provided pension fund rules that mandate participation by employees. However many contributors withdraw their savings before retirement, on termination or changes in employment, and may as a result reach retirement age without an adequate level of accumulated savings.

For this reason, mandatory preservation is widely seen as a desirable goal of retirement policy, linked to the continuation of tax-privileged contributions.

But this cannot realistically be achieved without a substantial enhancement of income support for the unemployed, and without fiscal assistance for retirement fund membership below the tax threshold.

Table 3: The retirement contribution funding gap

[1] Taxpayers earning a salary from a single employer only, and earning below R350 000, are not required to submit a return for SARS assessment.

[2] QLFS employment in 2020 Q1, with earnings distributions from the 2018 dataset adjusted to align with national accounts estimates of gross earnings and raised to 2021 prices.

[3] R45 000 a year is approximately the annual value of the 2021 national minimum wage of R21.69 an hour.

Download article

Post a commentary

This comment facility is intended for considered commentaries to stimulate substantive debate. Comments may be screened by an editor before they appear online. To comment one must be registered and logged in.

This comment facility is intended for considered commentaries to stimulate substantive debate. Comments may be screened by an editor before they appear online. Please view "Submitting a commentary" for more information.