What would it cost to subsidize a universal pension plan?

Broadening contributory pension coverage is a long-standing policy objective. For more than 20 years, commission reports and government policy statements have signaled the intent to establish a “comprehensive” social security system. Its central element would be a contributory pension plan.

What would be the budgetary cost of subsidizing a universal pension plan?

It could take the form of a statutory national fund, as proposed in the Green Paper on social security, recently released and subsequently withdrawn by the Minister of Social Development.[1] It could alternatively be implemented as mandatory participation in independently managed pension plans that meet statutory requirements.[2]

Internationally, subsidies for low-income contributors often form part of the social security system.[3] Without this, it is difficult to avoid widespread non-compliance by small firms and low-income workers. Budgetary co-funding of contributions at low earnings levels also serves a useful redistributive purpose, without detracting from the incentive to work.

Above the tax threshold, deductibility of retirement fund contributions provides an effective inducement to save. From a fiscal equity perspective, co-contributions for earners below the tax threshold would complement the implicit subsidy in the tax benefit enjoyed by higher income retirement fund members.

In assessing the merits of budgetary assistance for retirement fund participation, it is helpful to compare these with the costs of existing arrangements.

Fiscal support for old age and disability pensions currently takes three main forms:

- “Social assistance” grants, to a maximum value of R1 890 a month, are paid to persons over 60 (R1 910 for those over 75) or who are disabled, out of general revenue. These are subject to a means test. No grant is payable if after-tax income exceeds R86 280 for an individual, or joint income of R172 560 if married; or if assets (excluding a main residence) exceed R1 227 600 for an individual or R2 455 200 for a couple. The grant value is scaled down linearly, beginning at an income level of 1.5 times the maximum grant (combined income of three times the maximum for married couples), and reaches a de minimus R100 a month at an income level of approximately four times the maximum grant value (eight times for married couples).

- “Secondary” and “tertiary” rebates of R8 613 and R2 871 respectively, raise the personal income tax thresholds from R87 300 to R135 150 for taxpayers over age 65 and R151 100 for those over 75. More generous allowances for interest income are also available to the elderly.

- Retirement fund contributions are deductible up to a maximum of the lesser of R350 000 or 27.5% of remuneration or taxable income. The implied fiscal cost therefore depends on the marginal tax rate – for taxable incomes below R216 200 it is 18% of the contribution; for taxable incomes above R1 656 600 it is 45%. The accumulation of income within retirement funds is largely tax free but drawdowns from funds are taxed.

The 2021/22 annual fiscal cost of these arrangements is approximately as follows:

- Disability and old age grants (to 4 860 000 pensioners) – R110 billion

- Secondary and tertiary rebates (which benefit about 250 000 taxpayers) – R4.5 billion

- Retirement fund contribution deductions (to about 5 400 000 taxpayers) – R98 billion.

A key objective of a “universal pension plan” is to raise participation in contributory pension arrangements, so that a rising proportion of the population have funded incomes in retirement (or after disability) and are not solely reliant on social assistance. The gap is large – less than half of the total employed population (of about 16 million) are contributors to pension, provident fund, or retirement annuity plans.

A complementary objective is to increase preservation, as a subsidized statutory plan can more effectively impose preservation through its rules than discretionary or voluntary arrangements.

A third objective is to improve compliance with tax and social insurance arrangements, by rewarding reporting and formalization of employment through a cost-sharing incentive.

The costs of a subsidized plan depend on its parameters and coverage. We set out results below of two alternative subsidy options for a straightforward 10% contributory plan, based on the following design parameters:

- A full contribution subsidy up to an earnings level of R1 800 a month, a flat-rate subsidy of R180 a month for earnings between R1 800 and R6 000 a month, and a linear scale-down to zero at an earnings level above R9 000 a month.

- A de minimus flat-rate contribution of R150 a month for earnings levels below R3 000 a month, a 50% co-contribution subsidy of earnings between R3 000 and R6 000 a month, a flat-rate subsidy of R300 a month for earnings between R6 000 and R7 500 a month and a linear scale-down to zero at an earnings level of R9 000 a month.

These are both subsidy options that favour lower-income earners, while extending a measure of fiscal assistance into the income band above the tax threshold in order to achieve approximate equivalence between the subsidy and the deductibility of a 10% contribution. More exact equivalence could be effected by implementing the subsidy as a reimbursable credit up to an agreed maximum, or payment of a standard subsidy directly to individual retirement funding accounts.

While other subsidy designs are possible, these have clear advantages of simplicity and equity. They are also incentive-compatible in that a fiscal benefit is available continuously as earnings rise, without regard to the tax threshold. The design parameters can be adjusted to test the cost of alternatives.

The estimates below are based on QLFS employment numbers for the 2019/20 year (before the 2020 Q2 decline), and QLFS earnings distributions for 2018, raised to 2021 prices and adjusted upwards to align with aggregate earnings as estimated in the national production accounts.

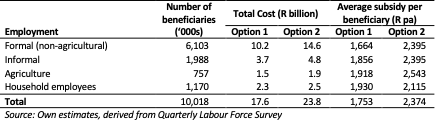

The estimated number of beneficiaries, average subsidy per annum and estimated total subsidy cost are summarized in Table 1, for formal non-agricultural employees and for the informal, agriculture and household sectors. The total cost as a percentage of gross remuneration is 0.55% for option 1 and 0.75% for option 2.

Table 1: Estimated subsidy costs of universal pension coverage

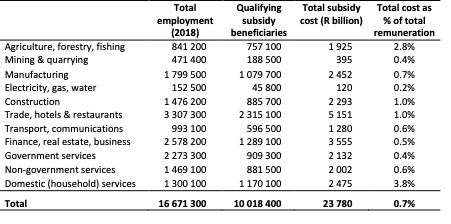

The approximate breakdown of qualifying beneficiaries and the cost of option 2 by the main industry categories is shown in Table 2.

A mandatory contributory pension plan, as envisaged above, would impact on employment costs and household disposable income. Its feasibility would depend on a long phase-in period and a financially sustainable balance between its economic impact and the costs of an accompanying co-contribution or subsidy arrangement. Over time, it would contribute both to national savings and to smoothing lifetime incomes and consumption.

The effect of the contribution subsidy would be to mitigate the impact of compulsory saving on household disposable income and consumption. A contribution subsidy similar in magnitude to that outlined above would add about 0.4% of GDP to government’s transfers to households, while also adding to the financial flows available for investment by retirement funding intermediaries.

A spreadsheet model that shows earnings distributions by sector and allows alternative subsidy parameters to be costed is attached here.

[1] Green Paper on Comprehensive Social Security and Retirement Reform (2021), Government Notice No. 45006, 18 August 2021. A notice of withdrawal of the paper was published on 31 August 2021.

[2] The 2004 National Treasury Discussion Paper on Retirement Fund Reform cautioned against compulsory participation of employees in retirement funds. It proposed further encouragement of preservation in occupational funds, the introduction of a national savings fund to accommodate contributors with irregular incomes and a system of individual retirement funds for contributors without a contractual employer-employee relationship.

[3] Richard Hinz, Robert Holzmann, David Tuesta, and Noriyuki Takayama, Matching Contributions for Pensions: A Review of International Experience. The World Bank, 2013.

Download article

Post a commentary

This comment facility is intended for considered commentaries to stimulate substantive debate. Comments may be screened by an editor before they appear online. To comment one must be registered and logged in.

This comment facility is intended for considered commentaries to stimulate substantive debate. Comments may be screened by an editor before they appear online. Please view "Submitting a commentary" for more information.