Place matters: National prosperity depends on every region performing better

Introduction

Economists and policy-makers seem to have a blind spot when thinking about how the economy functions and what determines success. Analytical frameworks and government policies consistently neglect the role of space and geography in favour of national averages and sectoral plans. Yet growing evidence from around the world shows the importance of place and location for productivity, growth, and development.

Intuitively, it is obvious that economic progress depends on the quality of local skills, capable public institutions, reliable infrastructure, and proximity to markets and suppliers. But just how important are these factors compared with the particular mix of local industries and macro-economic conditions?

In a paper just published in the SA Journal of Economics, we unpack the economic performance of different provinces to diagnose the significance of local factors and sectoral conditions.[1] This is helpful in understanding why some provinces consistently outperform others, and what might be done to help lagging regions improve their competitiveness.

Uneven development

The starting point is to recognise the systemic differences in the size and performance of South Africa’s regions:

Production is highly uneven across the country. Gauteng generates a third of national GDP - more than double the output of the next province - but with less than 1.5% of the land. According to SARS, individual taxpayers from Gauteng contribute 47% of the national total for this revenue source, despite constituting only 25.8% of the country’s population.[2]

Some provinces are more productive than others. The Gauteng and Western Cape economies expanded at an average rate of almost 3% per annum between 1995 and 2018, a third faster than the rest of the country. This growth premium added up to an additional R225 billion (2010 prices), which is roughly the size of the economy of the Eastern Cape.

There is growing divergence between the largest and smallest provinces. Over the last two decades the share of national GDP in the three largest economies (Gauteng, KwaZulu-Natal and the Western Cape) increased, while the share in the three smallest (North West, Free State and Northern Cape) contracted. Spatial inequalities have been further amplified by the Covid-19 pandemic.[3]

What lies behind the growing divergence between the best and worst performing regions? And what underpins the continuing growth and prosperity of Gauteng?

Why has development been uneven?

The performance of provinces is often attributed to their industrial structure: the problem with lagging regions is said to be their dependence on lagging sectors. Hence, the challenge for provinces such as Mpumalanga and the North West is their reliance on mining and related heavy industries because of rising energy costs and volatile commodity prices. The usual policy prescription is to find the means to diversify and industrialise. Yet industrialisation is unrealistic for many small towns. Bigger agglomerations have many advantages that make them more likely to benefit from spatially-blind national industrial policies. The unique strengths and limitations of each local eco-system need to be carefully considered as opposed to generic plans that gain little local traction.

There are several reasons why economies develop unevenly between places, including:

- The industrial structure and whether it is dominated by relatively dynamic or stagnant clusters of firms and their suppliers.

- Natural resource endowments, including mineral reserves, soil quality, rainfall, topography and location.

- The quality of physical infrastructure, such as road, rail and harbours, but also public utilities and municipal services.

- The skills and capabilities of the local workforce, including basic education and tertiary institutions.

- The quality of local institutions, including municipal leadership and technical competence, but also the efficacy of community-based organisations, business councils, industry associations and trade unions.

These differences can be important, especially as the effects are cumulative and mutually reinforcing over time. Provincial economies are not passive platforms that respond to national trends and global forces in similar ways.

Shift-share: separating out national industry vs place-based effects

There are potent implications for policy from this thinking. For instance, to accelerate growth within the Eastern Cape, would it be best to incentivise key industries, such as the automotive sector? Or would public resources be better spent on improving the operating environment for a variety of businesses, such as through upgrading the infrastructure? A third possibility could be to boost the quality and supply of particular skills that are in high demand by local firms.

It is difficult for policymakers to disentangle the multiple factors and forces underpinning regional growth and to pinpoint those with most potential to accelerate development. A sensible place to start is to disaggregate variables associated with national conditions from the distinctive circumstances prevailing within each region.

Shift-share analysis is a common technique for this purpose. This separates out the change in output for a region into three main components: growth arising from national industry trends (i.e. the industry-mix effect), growth arising from cross-cutting productivity (i.e. the region effect), and growth related to industry-specific locational advantages (i.e. the industry-place interaction effect).[4] In other words, shift-share analysis separates out region specific (or ‘place-based’) effects from nationwide industry sources of growth for each province.

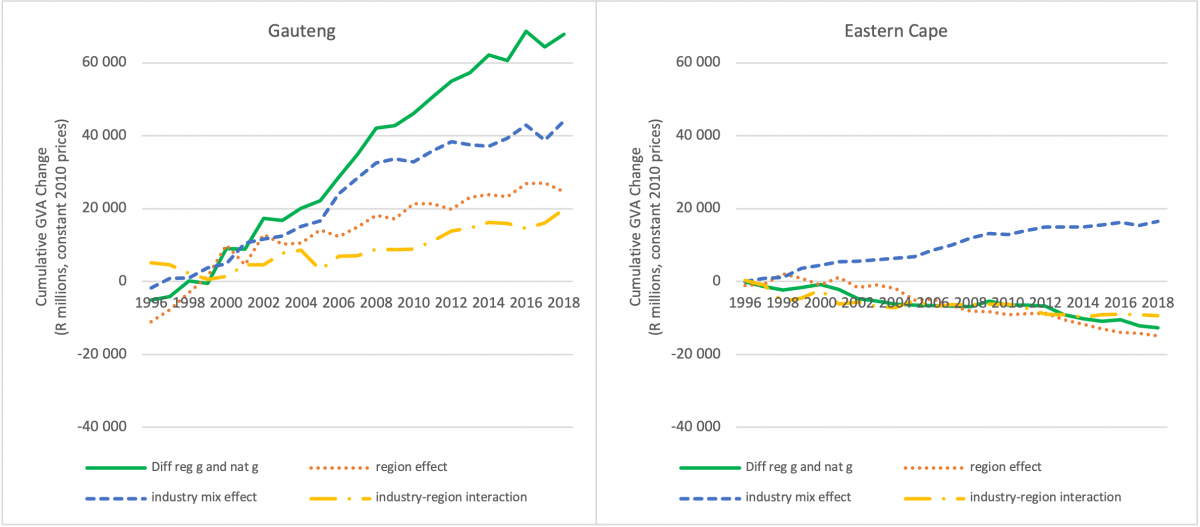

Figure 1: Dynamic shift-share decomposition of provincial GVA growth, 1995 – 2018

Source: StatsSA 2020: P0441, own estimates

Notes: ‘Diff reg g and nat g’ stands for the ‘difference between regional growth and national growth’ and is hence the regional growth differential.

Figure 1 illustrates the results of a shift-share analysis between 1995 and 2018 for Gauteng and the Eastern Cape as a leading and lagging province respectively.

The cumulative difference between provincial growth and national growth for Gauteng is positive and keeps on growing over the period (i.e. the green line). The opposite is true of the Eastern Cape, which starts to slowly fall behind the national average. In other words, the Gauteng economy performed better than other regions in South Africa over the past two decades whilst the Eastern Cape fared slightly worse.

The shift-share then breaks up this growth advantage/disadvantage into its industry versus place-based components.

In Gauteng, the regional growth premium includes its favourable industry mix (i.e. the blue line), which added more than R44 billion to the economy over the period. Gauteng’s relative specialisation in high-growth tertiary sectors such as banking, retail, and logistics gave it an advantage compared with other provinces where these sectors were under-represented. Gauteng also had strengths in industries that did not perform as well nationally, such as manufacturing, but on balance the industry mix was strongly positive.

Gauteng’s economy was also boosted by favourable region-wide dynamics (i.e. the orange line), which added R24.7 billion. This means that firms in all sectors were typically more productive than those elsewhere, presumably because operating conditions in the province were more conducive. The industry-region interaction effect (i.e. the yellow line), which captures sector-specific regional advantages, was also positive at R19.8 billion, mostly because firms in finance and business services performed particularly well. This is over and above the nationwide growth average for that sector (industry-mix effect) and the across-the-board productivity boost experienced by all firms in Gauteng (region effect). The region effect and industry-region interaction effect add up to R44.5 billion, which is slightly higher than the industry-mix effect. This means that firms in Gauteng benefited as much from place-based factors as they did from nationwide industry trends.

The Eastern Cape also benefited from a favourable overall industry-mix, which was responsible for an extra R22.2 billion Gross Value Added (GVA) over the period. The province actually had a similar industrial profile to Gauteng – although with fewer business/financial services and more government and personal services.

Yet, in the case of the Eastern Cape, place-based factors worked against its industry-mix and even reversed this benefit. Firms in the Eastern Cape experienced both a negative region effect (-R14.9 billion) and region-industry interaction effect (-R9.3 billion), which together outweighed the positive industry-mix effect. This seems plausible considering the historic economic and social underinvestment in the former homelands of the Transkei and Ciskei, which may continue to impose a growth penalty on the region. Parts of the Eastern Cape have some of the highest levels of unemployment and poverty in the country

Conclusion

It is vital that national growth plans pay careful attention to the unique features of each region if they are to succeed. The results of the shift-share analysis show how both nationwide industry trends and place-based effects are important in shaping provincial performance. One implication for policymakers is that targeting growth sectors cannot be the sole focus of industrial policy.

The findings call for more detailed analysis of the core features of each province to help them navigate structural change, including the performance of the metro economies. A more devolved approach to national economic policy could build on the strengths of every region. The national economy is hamstrung if only some regions manage to grow.

Addressing the paucity of economic data at local and provincial levels is crucial to pursue this approach. The widening of regional economic disparities seems to have been overlooked by economists and government analysts. This is surprising considering the legacy of apartheid and the high stakes involved in reducing entrenched inequalities between regions.

The divergent economic trajectories of different regions should be tested at different spatial scales to further interrogate these dynamics. Spatial inequalities are also crucial in planning for internal migration flows.

[1] Visagie, J & Turok, I (2021) Firing on all cylinders: Decomposing regional growth dynamics in South Africa. South African Journal of Economics, DOI: 10.1111/saje.12303. https://onlinelibrary.wiley.com/doi/full/10.1111/saje.12303

[2] National Treasury. (2019b) 2019 Tax statistics. December 2019. Pretoria: South Africa.

[3] Visagie, J and Turok, I (2021) Rural–urban inequalities amplified by COVID-19: evidence from South Africa. Area Development and Policy, 6(1): 50-62, http://doi.org/10.1080/23792949.2020.1851143

[4] The shift-share also includes an allocation effect (which is the difference between the crude and standardised national growth rates), which is necessary for unbundling the components of growth but not relevant in the interpretation of the results when comparing regions.

Download article

Post a commentary

This comment facility is intended for considered commentaries to stimulate substantive debate. Comments may be screened by an editor before they appear online. To comment one must be registered and logged in.

This comment facility is intended for considered commentaries to stimulate substantive debate. Comments may be screened by an editor before they appear online. Please view "Submitting a commentary" for more information.